I. Introduction

Mergers and acquisitions (“M&A”) have emerged as a widely adopted strategy for corporate entities worldwide, facilitating rapid inorganic growth. With globalization and various catalysts at play, emerging markets like India have experienced significant M&A activity spanning diverse sectors such as pharmaceuticals, automobiles, finance, and telecom. To attain enhanced synergies, corporations employ various forms of strategic restructuring, including schemes of mergers and amalgamations.

Among these restructuring mechanisms, reverse mergers or reverse takeovers (“RTO”) represent a noteworthy approach. In an RTO, a smaller private company strategically acquires control over a larger public company. Typically, the public company functions as a mere shell, and the shareholders of the private entity gain majority shares and board control in the public counterpart. Through the exchange of shares, the private company’s shareholders effectively transform it into a publicly traded entity without undergoing the traditional initial public offering (“IPO”) process.

This blog aims to explore the primary drivers and challenges associated with RTOs on a global scale. Additionally, it assesses the effectiveness of the regulatory framework overseeing RTOs in the Indian context, shedding light on contemporary legal concerns surrounding this regulatory framework supported by various case laws.

II. Understanding the Process of Reverse Mergers

- Precedent Conditions

The Gujarat High Court, in the renowned “Bihari Mill Case”[1], has delineated a comprehensive test for determining the applicability of a reverse merger. The test comprises the evaluation of specific parameters, including:

- Comparison of the assets of the holding company with those of the subsidiary company.

- Assessment of whether the net profit of the holding company surpasses that of the subsidiary company.

- Examination of whether the consideration offered by the subsidiary company exceeds the value of the net assets of the holding company.

- Analysis of whether the equity share capital, issued by the subsidiary company as consideration for the acquisition, exceeds the existing equity capital of the subsidiary company before the acquisition.

- Evaluation of whether the issuance of shares in the subsidiary company would result in a change in control through the introduction of a minority holder.

2. Characteristics of Transaction

The reverse merger transaction is primarily structured in two distinct ways:

- Direct Reverse Merger: In this configuration, the public shell company, strategically created for executing the reverse merger, directly acquires the private company. Subsequent to the transaction’s completion, the owner of the private company assumes the role of the predominant stakeholder in the public entity.

- Reverse Triangular Merger: This structure further divides into two subsets:

- Merger of a Wholly-Owned Subsidiary and the Private Company: This arrangement orchestrates the merger between a wholly-owned subsidiary and the private company. The outcome positions the shareholder of the private company as the principal stakeholder in the public entity.

- Merger of a Wholly-Owned Subsidiary and its Parent Listed Company: In this subset, the merger unfolds between a wholly-owned subsidiary and its parent listed company. The design ensures that the shareholder of the private company emerges as the predominant stakeholder in the resulting public entity.

III. Statutory Provisions governing the Reverse Merger in India

- Companies Act, 2013

Section 232 (h) of the Companies Act, 2013 explicitly stipulates that in the event of an amalgamation between a listed company and an unlisted company, the resulting entity shall be categorized as an unlisted company until it completes the transition to a listed status. This provision effectively imposes a constraint on accessing the capital market through the backdoor route

2. SEBI Regulations

In accordance with the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, the merger of an unlisted company with a listed one (with the latter surviving as the listed entity) necessitates prior approval from the stock exchange for the proposed scheme of arrangement. Additionally, SEBI, through a circular dated March 10, 2017, has outlined specific requirements pertaining to arrangements by listed entities:

- The listed company is mandated to furnish information about the unlisted company, alongside the proposal submitted to the shareholders.

- Shareholders of the listed company and Qualified Institutional Buyers of the unlisted company must collectively hold at least 25% or more in the shareholding pattern of the merged entity.

- Unlisted entities can only be amalgamated with listed entities that are listed on stock exchanges with nationwide trading terminals.

- Income Tax Act, 1961: Section 72A of the Income Tax Act, 1961, provides that an entity resulting from the amalgamation of a distressed company can avail the benefit of accumulated losses and allowances for depreciation accrued to the sick company.

However, two prerequisites must be satisfied to harness the benefits under this section:

-

-

- All assets and liabilities of the amalgamating company must be transferred to the amalgamated company as per the scheme.

- Shareholders holding not less than 90% in value of shares in the amalgamating company should become shareholders of the amalgamated company as a consequence of the scheme.

-

IV. Case Laws Revealing Challenges and Gaps in Reverse Merger Jurisprudence in India

Addressing challenges and disparities in reverse mergers is pivotal to safeguard the rights of minority shareholders and uphold a just and transparent evaluation process. Exploring pertinent case studies sheds light on these issues:

- Yatra Online Inc-Terrapin Acquisition Corporation Merger (2016): The merger between Yatra Online Inc, an Indian online travel agency, and Terrapin Acquisition Corporation, a U.S.-based publicly traded special purpose acquisition company (“SPAC”), aimed at taking Yatra Online public in the U.S. market. This cross-border reverse merger underscored the complexities involving regulatory compliance and shareholder rights. It accentuated the necessity for a robust legal framework to ensure the protection of minority shareholders and transparency in such transactions.

- Vodafone-Idea Merger (2018): Involving a reverse merger structure, the merger between Vodafone India (Indian subsidiary of Vodafone Group) and Idea Cellular (a publicly traded Indian telecom operator) aimed to create a formidable entity in the Indian telecom market. This case spotlighted issues such as minority shareholder rights, fair valuation, and competition concerns in the telecom sector. It underscored the need to address appraisal rights and protect the interests of minority shareholders, especially in regulated sectors with potential consumer impact.

These case studies vividly expose the challenges and gaps prevalent in reverse merger jurisprudence in India. They accentuate the critical role of tailored legal frameworks, vigilant regulatory oversight, transparency, and the safeguarding of minority shareholder rights. Establishing a robust foundation is essential to ensure fairness and transparency in the intricate processes of reverse mergers, thereby fortifying the Indian corporate legal landscape.

V. CONCLUSION AND THE WAY FORWARD

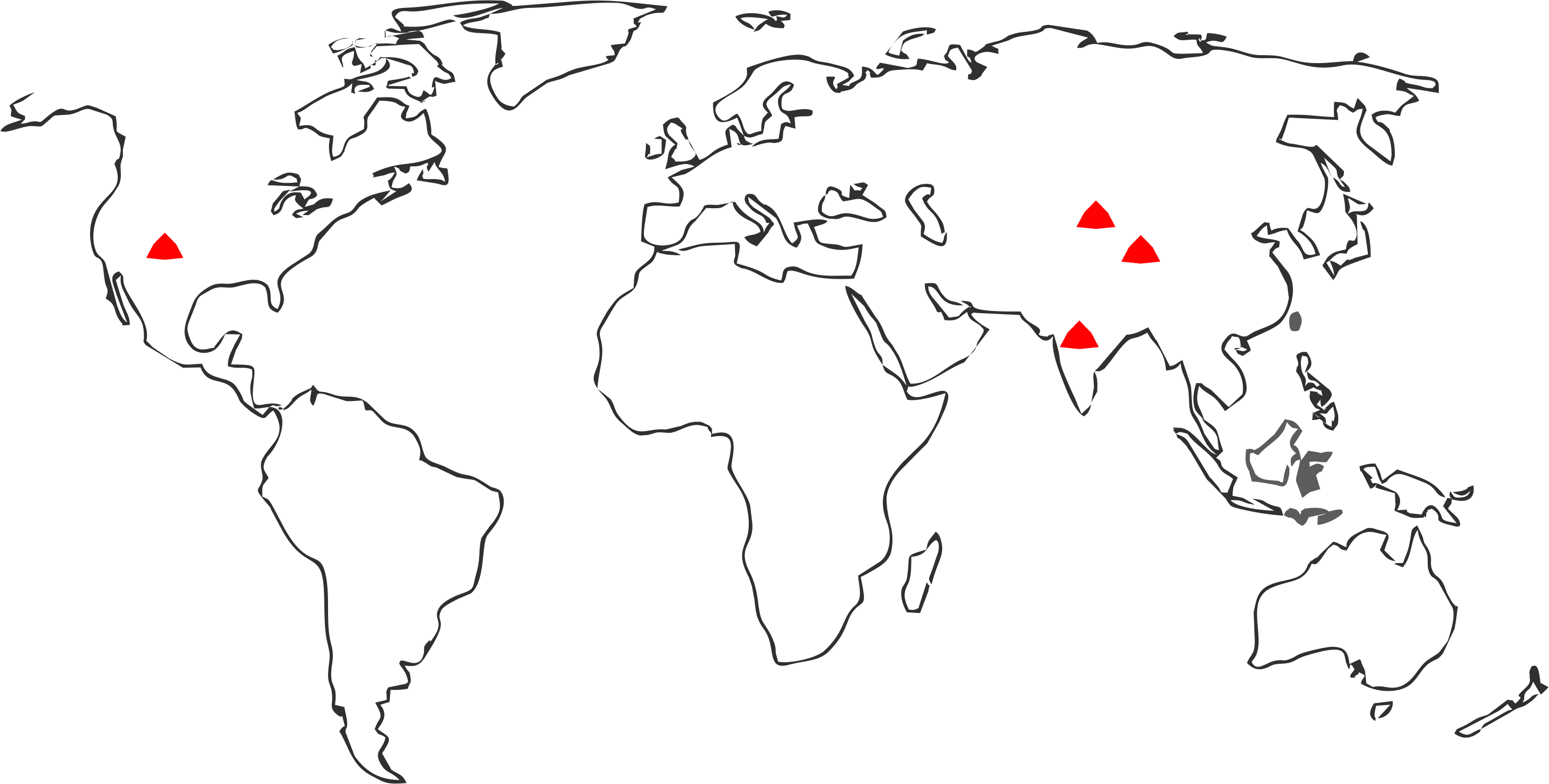

Observing the increasing significance of Reverse Mergers in recent years, it is evident that this method is poised to become a predominant choice for public listings worldwide. Developed and developing nations alike recognize the strategic advantage of reducing time and costs to gain a competitive edge. This underscores the global preference for methods that comprehensively serve both objectives. A jurisdiction boasting robust corporate laws and stringent control, coupled with credible auditing agencies, stands as the optimal environment to fully leverage the benefits of Reverse Mergers.

While there are no direct provisions specifically governing the operations of reverse mergers, the authority vested in the Securities and Exchange Board of India (SEBI) facilitates comprehensive monitoring of such transactions. SEBI, entrusted with the critical analysis of each case, plays a pivotal role in granting permissions. Reverse Mergers have garnered popularity among business entities due to their streamlined mechanisms and time-saving attributes. Nevertheless, for optimal outcomes in this restructuring approach, regulatory authorities must exercise stringent control. Upholding strict oversight ensures the effectiveness and integrity of the Reverse Merger process.